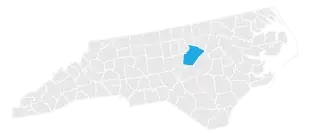

wake county nc sales tax calculator

How much is sales tax in Wake County in North Carolina. Sales tax in wake county north carolina is.

Wake County Nc Property Tax Calculator Smartasset

The calculator should not.

. The minimum combined 2022 sales tax rate for Wake County North Carolina is. The December 2020 total local sales tax rate was also 7250. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

This takes into account the rates on the state level county level city level. Wake Forest NC Sales Tax Rate The current total local sales tax rate in Wake Forest NC is 7250. This calculator is designed to estimate the county vehicle property tax for your vehicle.

This includes the rates on the state county city and special levels. The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200. 694 Average Sales Tax Summary The average cumulative sales tax rate in the state of North Carolina is 694.

A single-family home with a value of 200000. The sales tax rate for Wake County was updated for the 2020 tax. Ad Avalara AvaTax can help you automate sales tax rate calculation and filing preparation.

The North Carolina state sales tax rate is currently. Wake Forest is located within Wake County. The December 2020 total local sales tax rate was also 7250.

This includes the rates on the state county city and special levels. Sales tax in Wake County North Carolina is currently 725. Wake county nc sales tax calculator.

For comparison the median home value in Wake County is. Search real estate and property tax bills. The 725 sales tax rate in cary consists of 475 north carolina state sales tax 2 wake county sales tax and 05 special tax.

2020 rates included for use while preparing your income tax deduction. Our free online North Carolina sales tax calculator calculates exact sales tax by state county city or ZIP code. The current total local sales tax rate in Wake County NC is 7250.

This rate includes any state county city and local sales taxes. The average cumulative sales tax rate in Wake Forest North Carolina is 725. First we used the number of households median home value and average property tax rate to calculate a per capita property tax collected for each county.

Raleigh is located within Wake County North. Please enter the following information to view an estimated property tax. Start filing your tax return now.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. How to calculate taxes Tax rates are applied against each 100 in value to calculate taxes due. Wake County Tax Administration.

This is the total of state and county sales tax rates. The average cumulative sales tax rate in Raleigh North Carolina is 725. Learn about listing and appraisal methods appeals and tax.

The latest sales tax rate for Wendell NC. As a way to measure the quality. Prepared Food Beverage Division.

For assistance in completing an application or questions regarding the Prepared. Take the burden of sales tax compliance off your plate with help from Avalara AvaTax. Pay tax bills online file business listings and gross receipts sales.

Wake County in North Carolina has a tax rate of 725 for 2022 this includes the North Carolina Sales Tax Rate of 475 and Local Sales Tax Rates in Wake County totaling 25.

How To Calculate Sales Tax A Simple Guide Bench Accounting

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Sales Taxes In The United States Wikiwand

2022 Property Taxes By State Report Propertyshark

North Carolina Sales Tax Guide And Calculator 2022 Taxjar

North Carolina Income Tax Calculator Smartasset

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

King County Wa Property Tax Calculator Smartasset

North Carolina Vehicle Sales Tax Fees Calculator Find The Best Car Price

Irina Comer For Wake County Commissioner

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Sales Tax Guide For Businesses

How To Charge Sales Tax In The Us 2022

Arizona S Combined Sales Tax Rate Is Second Highest In The Nation Arizona Capitol Times